For Tax Year 2021, single taxpayers will be eligible for the full. “The provision still allows you to claim the nonbusiness energy property credit for 10% of amounts paid for qualified energy efficiency improvements, up to a lifetime cap of $500,” Greene-Lewis said. As tax season goes on, one of the things to do is pay attention to changes in tax deductions and tax credits you can claim when filing your 2020 income tax return with the Internal Revenue Service, which is due by May 17, 2021.The federal filing date has been pushed, but note that this does not mean state taxes are due later than their deadline of April 15. The Child Tax Credit decreases taxpayers’ tax liability on a dollar-for-dollar basis. A notable change, however, is that the maximum income threshold has changed significantly. Credits for nonbusiness energy property improvements made to your home (such as installing energy-saving roofs, windows, skylights, doors, etc.) were extended through 2021.The ability to write off any mortgage insurance premiums paid, which are included in the mortgage interest deduction, was extended through 2021. The letters are going to families who may be eligible based on information they included in either their 2019 or 2020 federal income tax return or who used the.If you experienced a foreclosure, short sale or loan modification, you may still be able to exclude the amount of debt forgiven on your principal residence on your taxes.For tax years beginning in 2020, volunteer firefighters and volunteer medical responders will be able to exclude payments provided by state and local governments for performing emergency response from their income.That threshold was set to increase from 7.5% to 10% in 2020, but the reduction was permanently passed.

#Child tax credit 2020 changes full#

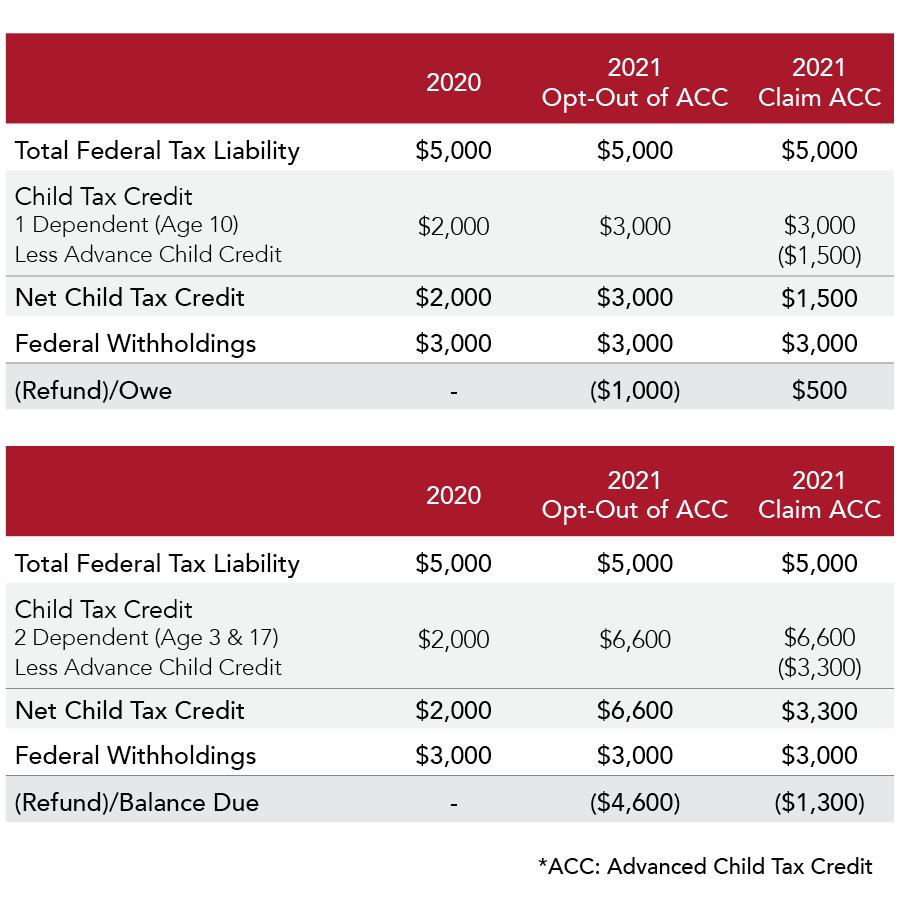

The full amount of the credit could be received as a refund. Taxpayers can deduct qualified, unreimbursed medical expenses that are more than 7.5% of their 2020 adjusted gross income. The HEROES Act would raise the maximum credit (for 2020) to 3,600 for each child under 6 and 3,000 for those ages 6 - 17.

0 kommentar(er)

0 kommentar(er)